Frame Financial Factors

By Mark Clark

Learning Objectives:

Upon completion of this course you should understand:

- Describe purchasing and board management strategies used in the eyecare industry

- Explain how ancillary costs such as shipping, and warranties affect the bottom line

- Show how third-party plans affect profit and purchasing strategies for the dispensary

Faculty/Editorial Board:

Mark Clark is a business analyst at GPN Technologies, an optical KPI software company. He also is a Forbes Business Development Council member and has a master’s degree in healthcare management. Outside work, he is a father of six and enjoys providing a home for displaced wild mustangs.

Mark Clark is a business analyst at GPN Technologies, an optical KPI software company. He also is a Forbes Business Development Council member and has a master’s degree in healthcare management. Outside work, he is a father of six and enjoys providing a home for displaced wild mustangs.

Credit Statement:

This course is approved for one hour of ABO CE credit at level Non- General Education, Course number SWJHI031

This course covers all aspects of inventory profitability, frompurchasing inventory to billing for products. It will providean overview of financial concepts and third-party billingconcepts related to the eyecare dispensary.

WHY STUDY PROFIT?

Eyecare falls into a unique space that comprises retail and health care under the same umbrella. The retail side of the business exists for the purpose of profit (Fig. 1). However, profit in the dispensary is often much more complex to calculate than in other industries. In all types of business, profit is generally defined as financial gain. Who doesn’t want to gain financially? This is why we go to work each day. The purpose of every frame in the dispensary should be to create profit. The word itself does not sound that exciting, but it is the main goal of every enterprise. Profit is why we get paychecks, raises, bonuses or vacations.

ADDING UP THE COSTS

COGS or “Cost of Goods Sold” is a general business term used to reference all the costs associated with acquiring a product to resell. Concerning an optical frame, this would include the cost of the frame itself, the cost of shipping and the cost of handling. These costs can add up quickly! Regularly exchanging products in your inventory will have additional shipping costs added to your inventory COGS. In this case, you have added the cost of receiving it originally and the cost to ship back the inventory that you have exchanged. Inventory strategy is something that will be covered later in this course. Frame profit can be defined as the total amount collected for the frame minus the total cost of the frame.

HOW INSURANCE AFFECTS PROFIT

FIG. 1

When a patient purchases eyewear without insurance coverage, this is often referred to in the optical industry as a cash sale or a cash patient. Calculating the frame profit on a cash sale is simple. You simply subtract the cost of acquiring the frame from the amount paid for the frame. In this case, your frame markup strategy determines the profit on the frame. In the case where a patient also has an insurance plan, the total revenue received for a frame is often the combined total of the patient’s frame co-pay and the insurance reimbursement for the frame. The profit on the frame in this scenario is calculated by subtracting the COGS from the total revenue received. However, insurance plans may have complex formulas for reimbursement and calculating the out-of-pocket amount. This can make the concept of frame inventory profit more difficult to calculate and forecast. In some cases, these formulas may make the frame markup strategy of the office irrelevant to the profit on that frame.

Most plans fall into two general categories based on how they determine frame allowances and the patient’s out-ofpocket expense: wholesale-based plans and retail-based plans. These two categories have very different reimbursement formulas, which affect profit. Wholesalebased plans have both a retail and a wholesale allowance for the patient, while retail-based plans only have a retail allowance.

The plan design aims to give the patient the same general coverage despite which provider they use. The unintended consequence of this is the complexity of plans for the office. We will spend more time on wholesale-based plans because of the complexity that they create concerning profit.

WHAT IS A “WHOLESALE-BASED” PLAN?

Wholesale-based plans are much trickier in terms of understanding your profit. This is because these plans have both a retail and a wholesale allowance that will be used to calculate the out-of-pocket cost to the patient. In turn, this will greatly affect your profit on these frames. For any frame with a list price that is less than the plan allowance, there will be no additional patient out-of-pocket expense on the frame. For any frame with a list price that is more than the plan allowance, you will be able to charge the patient the difference between your retail price for the frame and the plan retail allowance minus a discount. This discount is applied to the difference in the retail allowance and is typically 20 percent for most plans. These figures represent a common wholesale-based plan with both a retail and a wholesale allowance.

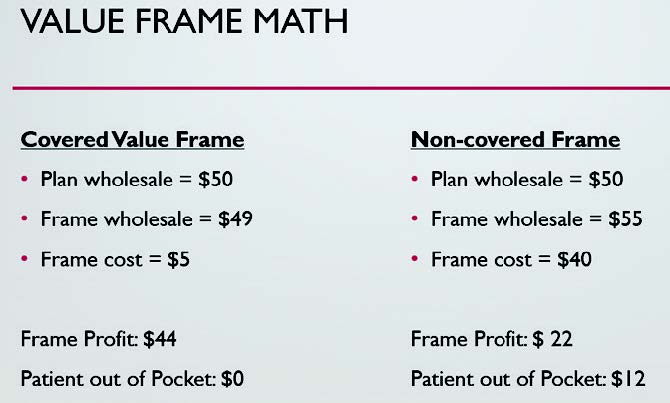

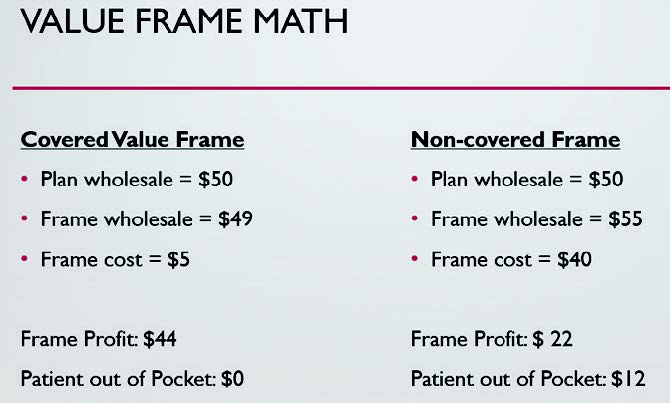

FIG. 2

In Fig. 2, we calculate based on the example of a wholesale-based plan, which has a wholesale frame allowance of $50 and a retail frame allowance of $130. It is important to note in this case that a frame with a list price of even $1 over the allowance will create a patient out-of-pocket expense calculated off of your usual and customary retail of the frame. On the other side of that equation, a frame that is only $1 under the plan allowance will have no additional outof- pocket to the patient. While some may focus on only purchasing products above the common wholesale allowance, many insurance contracts stipulate that the office must have a certain percentage of covered frames. You may also drive away customers who want to limit their out-of-pocket expenses. This is the purpose of value eyewear.

Your purchasing strategy is key to your dispensary’s profitability. For frames with a list price over the plan wholesale allowance, your inventory markup strategy will be the biggest factor influencing your profit and the out-of-pocket expense to the patient. For frames with a list price under the plan wholesale allowance, the only way to increase your profit is to decrease your overall cost of the frame. One way to do this is to purchase from a value vendor. These vendors create frames in these categories with very large discounts off the list price. Another strategy is to purchase these products in bulk to decrease shipping costs.

How do value frames increase profit over frames with lower discounts? In Fig. 2, we are also comparing two different frames on the same fictitious wholesale plan. One frame is a value frame that is covered because of the wholesale allowance of the plan. The second frame is slightly over the allowance and is not covered. It is important to note that the value frame cost is significantly lower than the list price. However, a non-value frame may only have a discount of 20 percent off of the list price. Notice that with the non-covered frame, the profit goes down, and the patient out-of-pocket goes up. This is bad for the practice and bad for the patient. As the patient’s out-ofpocket increases, some patients may seek other sources for eyewear. This can negatively affect the capture rate. We will look at this concept again in the section on capture rate. On a wholesale-based plan, it is very easy to have a situation with little or no frame profit when you begin to add up the costs of a frame under the allowance.

FIG. 3

In Fig. 3, the vendor discount was only 20 percent, but the shipping costs were $10. Together in this scenario, there was no profit. When you factor in the cost of labor, warranties and insurance billing software, this sale would likely have a negative profit margin. This is why many offices utilize frames from a value-priced frame vendor for their covered frame options.

Retail-based plans are much simpler to calculate. They only have a retail allowance for calculating the patient out-of-pocket. When calculating the patient out-of-pocket cost, simply subtract the plan allowance from the office’s retail price of the frame, then subtract the plan discount. Many plans have a 20 to 30 percent discount that is applied to frame overages. It is important to read the plan details when calculating overages. The profit on a retail-based plan is much simpler to calculate as well. Simply add up the revenue received from the patient and the insurance plan, then subtract your cost of goods. Vendor discounts will still have an impact on your margins, though not as significantly as with wholesale-based plans.

INSURANCE CONTRACTS AND POLICIES

Most insurance contracts will stipulate that you are to report your usual and customary retail charge for the frame sold to the patient. If you were to be audited, and the insurance found that this was not your usual price for this product, you could fail an audit. In other words, you cannot report a higher price to the insurance company simply to gain more profit. Offices should refer to their contracts and representatives about the specific terms and conditions related to the plan. Each plan and contract may vary by employer and by state. Since the charge must be considered “your usual fee,” you cannot have a separate price for cash customers as insurance customers. This is an important consideration when selecting a mark-up strategy. Too low of a markup may harm your margins, while a markup that is too high may drive away cash customers. Understanding your insurance payments is key to understanding the profit in your office. The explanation of payment is often called a remittance.

Insurance remittances may be very different depending on whether or not the plan requires the use of a contract or network laboratory. Once the insurance is billed and the claim is paid, you will receive a remittance explaining each item that was paid or debited. It is a common practice to evaluate each claim and patient record when the payment is made for accuracy. This will ensure that the patient was charged correctly and that the claim was paid correctly.

When an insurance company has a contract or network laboratory, this means that you do not have a lab bill for the lenses and lens options. However, there may be negative amounts on your remittance to pay for these lenses. These negative charges are called “Chargebacks.” Since the office collects the co-pays for these advanced lens options, the insurance “charges back” the amount needed to pay for the option. This is then subtracted from the total payment.

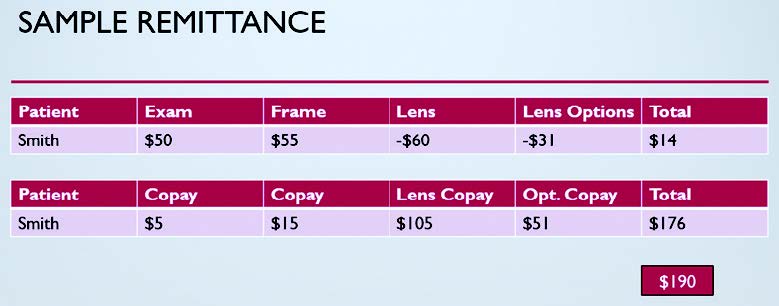

FIG. 4

If there are several expensive lens options, the insurance payment may seem small. However, it is important to look at the whole picture. In Fig. 4, the insurance paid $14, and the patient paid $176, but there was no lab bill to the office. So, the total amount paid to the office was $190. When you consider the total that the office received and consider that there will not be a bill for this patient from the lens laboratory, this plan is still profitable.

Now that you have looked at purchasing strategies and learned about various insurance plans, you can begin to craft your inventory strategy. I recommend taking time to review some insurance remittances of your most common plans, some benefit summaries of the plans and your vendor invoices. Using this data, you can determine which price points and vendors are most profitable to your dispensary. Then, craft a plan of what price points and vendors you need represented on your boards. Some offices create a section for exclusively “covered” frames. This section has been carefully selected to create a profit when a patient wants a covered option. Sometimes, this is a rack or a display off to the side.

INVENTORY AND PRICING STRATEGY

We all want a lot of fun frames! However, having a solid strategy for managing your frame inventory is key to increasing your profit and decreasing inventory headaches. Every dispensary should have a strategy for stock ordering, board management and vendor discounts. Each of these areas will contribute to the dispensary’s profitability and efficiency. Without a strategy, inventory can skyrocket while profit plummets! Offices should have a plan for how many frames to show as well as how often to place re-orders for each category of product. Some offices create a diagram or binder for their frame stocking and re-ordering strategy. Stocking your dispensary each day will require many decisions. You will decide how many frames to display and whether to carry any extra inventory. You will also decide which vendors and how many vendors that you will work with. You will also decide how often you want to replace frames that have been sold. Once you have your boards stocked, you will often have to order products to keep them looking full. Many times, it costs nearly the same to ship one frame as it would cost to ship two frames. A strategy to consolidate orders can result in thousands of dollars saved on shipping alone. For frames that sell quickly, offices may keep extra stock on hand to eliminate unnecessary shipments of single frames. The number of vendors you purchase from can also affect your bottom line. When you can have several lines shipped from the same vendor, you can consolidate your shipments even further.

BOARD MANAGEMENT

Board Management is a term to describe a strategy to control the inventory on your display boards. Having a strategy to manage your boards can help with space allocation, save time, prevent overstocking and create stronger brand representation.

When considering a board management strategy, it is best to begin by writing down the goals that you have for the inventory. These goals may include profitability or simply saving time with vendor appointments.

Often a board management strategy will include assigning spaces on the board for each line and each vendor. The vendor then works to keep their space properly stocked with inventory. This can decrease the time needed for vendor appointments while keeping the boards organized. It is important to consider your price and margin strategy when putting together a board management plan. Your frame inventory may often fall into three groups by price and discount level. Each of these categories can serve a purpose in your inventory for profit.

Covered frames (value frames) are required by most insurance companies. These are often inexpensive injection-molded acetates. These frames are also good for package eyewear sales and backup pairs. These are typically purchased at a discount off the listed wholesale price, up to 90 percent in some cases.

Mid-priced frames are often overlooked in terms of profit. These are quality frames with a one or two-year warranty. They may be sheet-cut acetates of moderate quality. These often do not have a brand name that the customer may recognize. Since no brand recognition exists, this category is most profitable from a high-discount vendor. This category is key to the price-conscious consumer who wants slightly more than the covered frame options. Mid-priced frames are often from reputable companies, yet do not have a brand name associated with them. They are often made of similar materials in the same factories. These frames have the potential for a very high margin for the office if purchased at a significant discount.

Brand names and luxury frames should round out the mix. These are often less of a discount but represent a high out-of-pocket to the consumer. However, since these frames often fall outside of the wholesale frame allowance, they often have the greatest profit for the dispensary.

We all want frames that sell. But how many times should you sell a frame without profit? The obvious answer is none! In some of the insurance plans that we have examined, vendor discounts have a large impact on profit.

TURN RATE

“Turn rate” for frames receives a lot of attention. Frame turn rate is often referred to as the number of times that a frame sells in a given time frame. However, almost all other industries use turn rate much differently. They use it to measure their overall price strategy and monitor the “holding cost” of their inventory. For instance, a product that is underpriced may have an abnormally high turn rate. An overpriced product may have increased holding costs. Since optical frames do not take up much space, holding costs are less relevant. One of the problems with focusing on “frame turn rate” is that it isn’t necessarily an indication of profit. For example, a frame that may have been improperly priced may sell simply because it is underpriced. In this case, the good turn rate is actually indicative of a problem. Remember the more you turn an unprofitable frame, the more negative profit you have! On the other side of this consideration, you also don’t want to keep frames in your inventory that will not sell. If a slow-moving frame is taking up space on the boards, you may consider replacing it if it does not fill a needed niche in size or style.

PRICING STRATEGY

Most markup strategies fall into two general categories: multiplier or sliding scale. When an office uses a multiplier, they typically multiply the list price by a number such as two times or three times. This is generally accepted. However, there are some drawbacks. High-margin value frames may be overpriced if the list price is used as a basis. Also, very expensive frames may be priced out of the market. In an attempt to keep expensive frames from being marked up too high, many offices will use a sliding scale. For example:

• List price $50-75 mark-up 3x

• List price $75-90 mark-up 2.5x

• List price $90+ mark-up 2x

This is just a general example of how a sliding scale would work. Each price group would have a general multiplier assigned.

SECOND PAIRS

For many years, consultants have told us to sell more second pairs. But the question is how? As the total price of the sale goes up, the price consciousness of the consumer may also increase. It is important to know how price conscious your market is and whether you need price-conscious strategies. You can decrease the costs associated with second pairs of eyewear in several ways. Utilizing a value-priced frame for a second pair can reduce the “sticker shock” while maintaining a strong margin. And since this pair will not likely be subject to an insurance formulary for lens selection, you may also be able to increase your lens profit by offering a “house brand” lens from your local laboratory. These are often designed very similar to name brand lenses but without the high mark-up of a name brand lens. Lastly, if you can send both pairs to the same laboratory, many labs will offer a second pair discount on the lenses for even further savings.

FRAME WARRANTIES

Most manufacturers offer some type of warranty on their products. This warranty can help you service your customers better. But warranties are not free. Some vendors have return rate limits, which could affect your purchase discount. And even without a limit on returns and exchanges, there is typically a cost associated with shipping frames back for the warranty or exchange.

A good practice is for vendors to save exchanges and warranties, and send them back in bulk rather than one frame at a time. This can represent significant savings in the shipping of returns. The cost of returning frames should be considered part of the total COGS (Cost of Goods Sold).

CAPTURE RATE AND THE MODERN CONSUMER

You may have heard the term “capture rate” in our industry. In the most basic terms, this is the total number of exams divided by the number of eyewear purchases in a given period. It is a measure of how many of your patients actually purchased eyewear as a result of their appointment. Many factors in and outside the practice today are affecting capture rates. As a whole, capture rates in the industry are trending towards only 50 percent. Consumer habits have been changing at an alarming pace. Digital and online purchasing continues to grow. Price consciousness, convenience and technology are all driving the changes in consumer habits. It is important to consider these influences when structuring a strategy for the dispensary. Again, begin to look at each frame for its potential for profit and patient capture. When economic conditions fluctuate, consumers go through phases of price consciousness. This can cause patients to seek lower-priced options for their eyewear or delay their purchases. When out-of-pocket expenses are high on frames, consumers may seek lower-cost options online or at discount eyewear locations. Utilizing high-margin value frame vendors is one way to increase capture rates during times of increased price consciousness. A high margin frame can increase profit while at the same time decreasing patient out-of-pocket costs. As we saw previously in the example of an insurance plan, a value-priced frame will often have a higher margin than a frame just slightly outside the plan allowance.

THE MODERN CONSUMER FOCUS

The Vision Council Consumer Insights report indicates year after year that convenience continues to be a key factor in where consumers purchase their eyewear. The data has indicated that both online and in-store shoppers make their final decision somewhat based on convenience. As the digital age continues to draw consumers online, they are more focused on convenience. When they shop online, they enjoy such benefits as fast/free shipping, easy ordering options and easy payment options. These websites often store their payment and shipping information for ease of use in the future. Consider ways that you can increase the convenience of your office in the eyewear journey. The journey to the office for the modern consumer begins online. They may begin by doing a Google search for their doctor’s office. Then, they may look at their website to consider what frames they want to purchase. Modern websites feature frame galleries and virtual try-on options. Consumers often try on eyewear online before visiting a local office. These sites will also often include online scheduling and contact lens ordering. Incorporating the right elements into your office journey is key to capturing and retaining your patients.

In conclusion, the profit of the dispensary is affected by many factors, including insurance formularies, market price consciousness, shipping costs and vendor discounts. Because of these factors, the modern office manager needs to develop a detailed strategy to maximize profit in the dispensary on frames.