Photographed by Ned Matura From top: MODZ SUNZ Lanikai from Modern Optical International; FIN from TOMS

It’s time to shine the light again on sunwear market trends with 20/20’s Sunwear MarketPulse Survey 2019. Conducted by Jobson Research, we surveyed over 200 independent eyecare professionals on how sunwear sales are performing and what market trends are emerging. Take a look at the following data showing how the sunwear category has developed and progressed in the last several years.

–Jennifer Waller, 20/20 Research Director

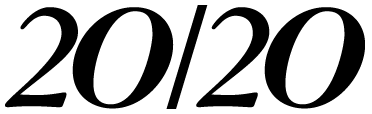

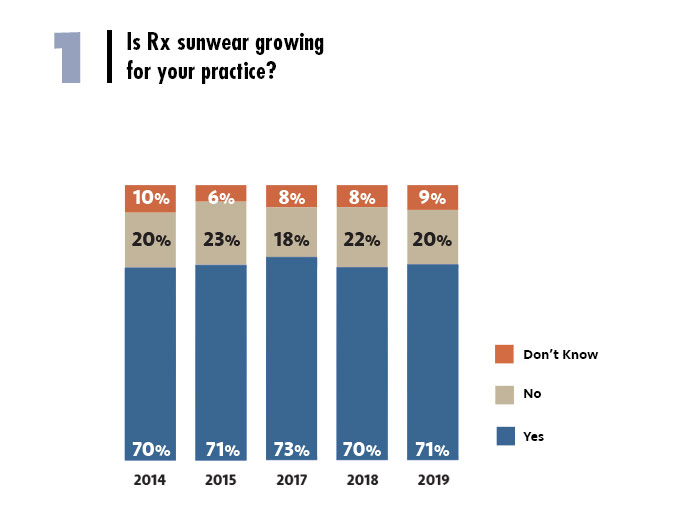

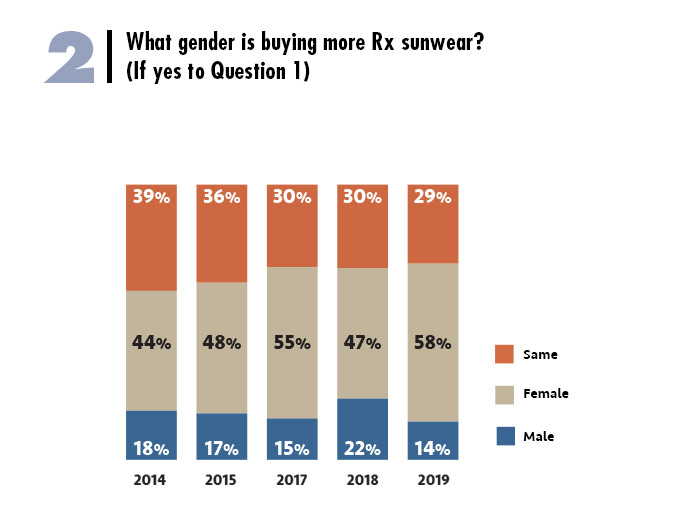

- Seventy-one percent of respondents said that Rx sunwear is growing for their practice. Adults (ages 35 to 44) accounted for the largest percentage of Rx sunwear sales (an average of 30 percent) according to those independents surveyed. Over half (58 percent) of respondents said that females are buying more Rx sunwear than males, 14 percent said males more than females, and 29 percent said the same for both genders.

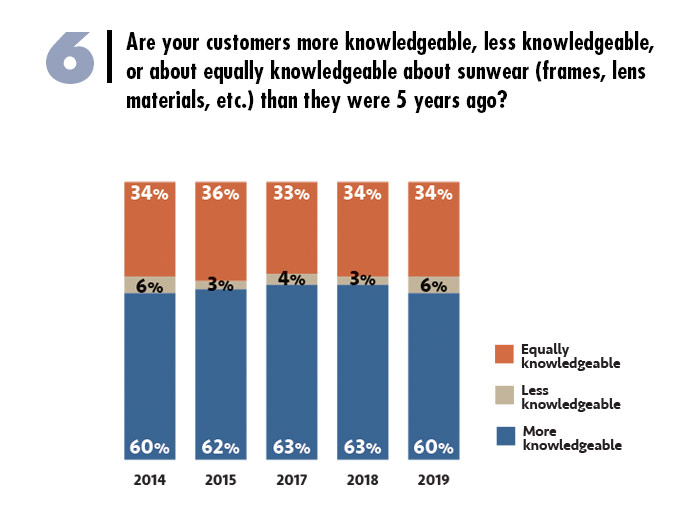

- Of the independents surveyed, 60 percent said consumers are more knowledgeable about sunwear than they were five years ago.

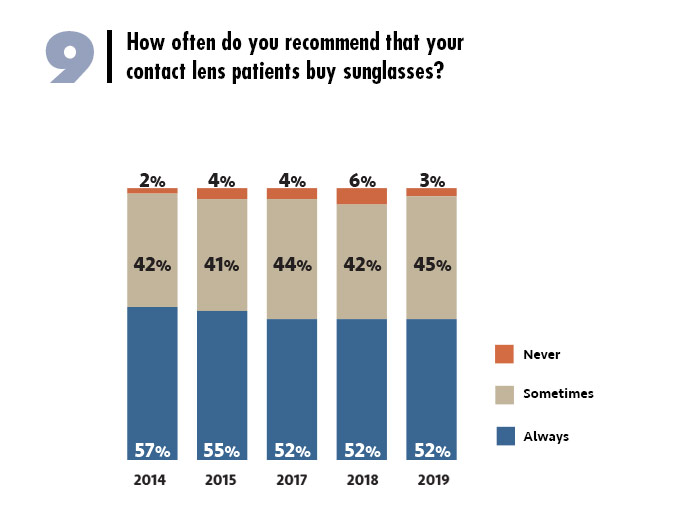

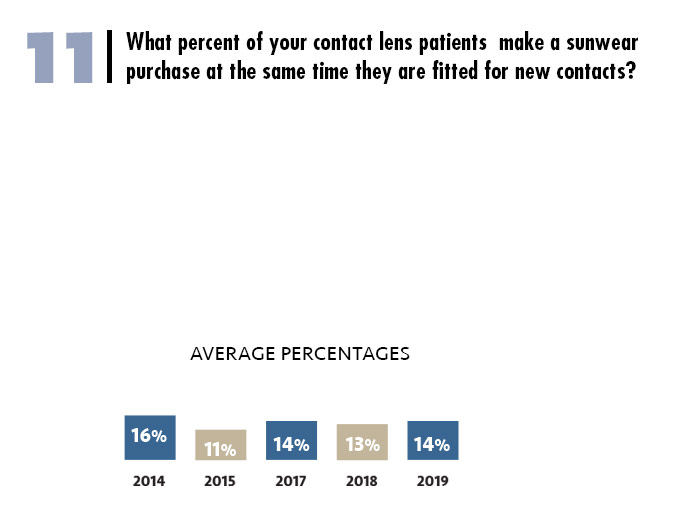

- More than half (52 percent) of independents surveyed said they always recommend their contact lens patients buy sunglasses. However, respondents said only 14 percent of their patients on average actually make a sunwear purchase at the time they are fitted for new contacts.

- More respondents (49 percent) disagreed than agreed (44 percent) with the statement that they feel the lines between fashion-oriented sunwear and sports-oriented sunwear are blurring (7 percent said “don’t know”). Of the 44 percent who agreed that the lines were blurring, 48 percent think this is helping the sales of both Rx and plano sunglasses. Only 6 percent claim the merging is hurting their sunwear sales.

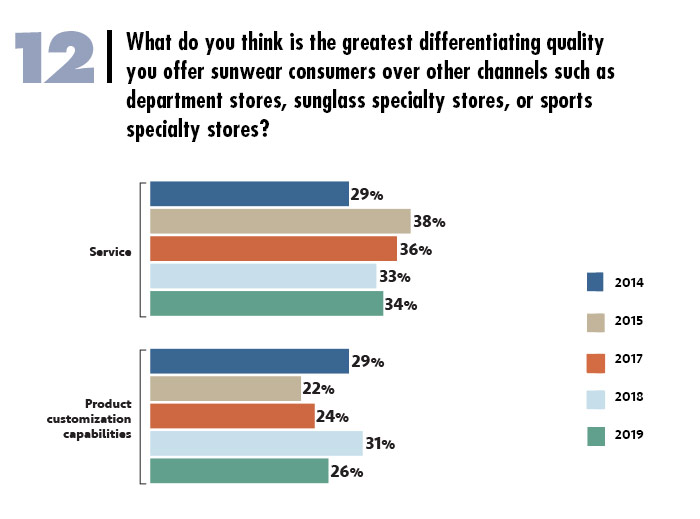

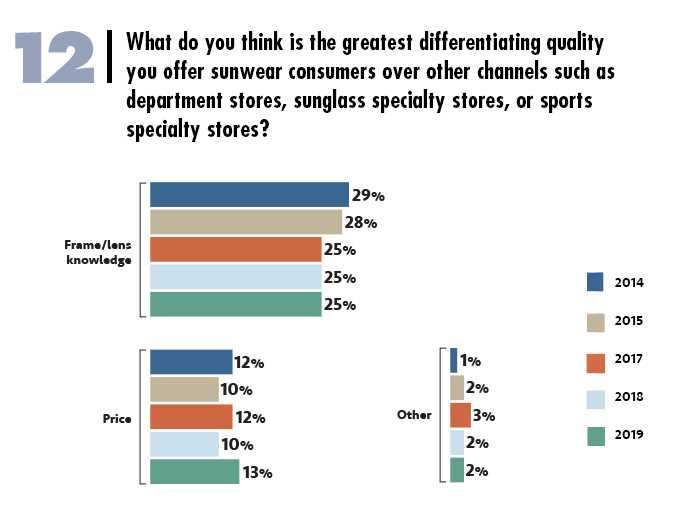

- When asked what the greatest differentiating quality independents have over other channels was, superior service takes the top spot with 34 percent, followed by product customization at 26 percent and frame/lens knowledge at 25 percent.

- On average, independents said polycarbonate lenses made up 45 percent of their total prescription sun lens sales and 42 percent of plano sunwear lens sales. Plastic/high-index plastic lenses made up 43 percent of total prescription sun lens sales and 44 percent of plano sunwear lens sales.

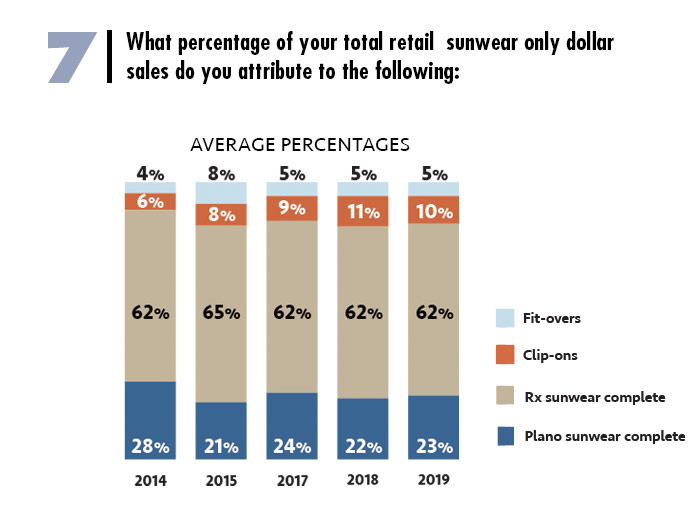

- On average, respondents said 62 percent of total retail sunwear comes from Rx complete, 23 percent from plano complete, 10 percent from clip-ons and 5 percent from fit-overs.

- Not surprisingly, July/August was rated the highest sunglass sales period for 70 percent of independents. May/June followed with 50 percent rating it as a “high” period for sunglass sales. For comparison, January/February came in only at 3 percent rating it high.

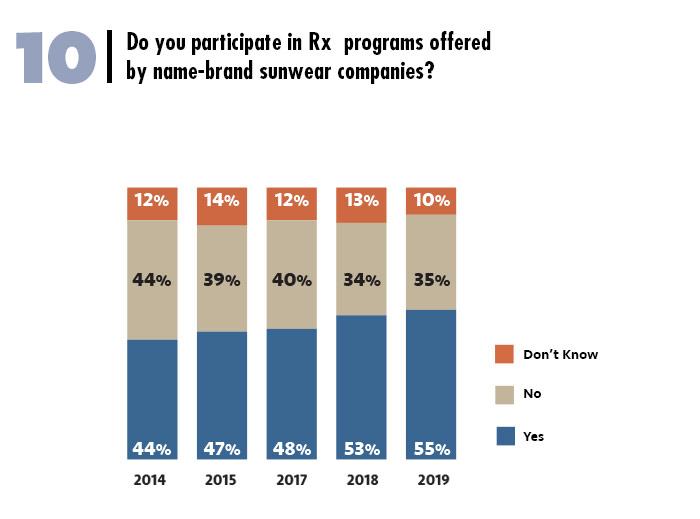

- More independents say they participate in Rx programs offered by sunwear companies (55 percent) than those who don’t (35 percent). Ten percent were unsure.

METHODOLOGY

20/20’s 2019 Sunwear MarketPulse Survey is based on data collected from structured e-mail interviews with 244 independent optical retailers. The samples were derived from the proprietary Jobson Database. All 2019 interviews were conducted in January 2019. Data is presented from a retailer or practitioner’s perspective and may reflect seasonal market and thus behavioral fluctuations. This study was also conducted in 2014, 2015, 2017 and 2018. Trended data is charted wherever possible. All participants were contacted via e-mail invitation and offered an incentive of a chance to win a $200 amazon.com gift card. For more information, contact [email protected] or 212-274-7164.